Roth conversion tax calculator 2020

For instance if you expect your income level to be lower in a particular year but increase again in later years. This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed.

Roth Conversion Calculator Fidelity Investments

One of the most important factors in the decision is what.

. This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. The 2022 Roth Conversion Calculator is a stand-alone widget is not integrated into PlannerPlus. If you know your exact taxable income or just estimate it you can convert only a portion that would not increase your tax rate.

An IRA is an individual retirement account where you receive a tax break for contributions today but pay taxes on withdrawals in retirement. Roth Ira Calculator Roth Ira Contribution Current age 1 to 120 Age when income should start 1 to 120 Number of years to receive income 1 to 30 Before-tax. The information in this tool includes education to help you determine if converting your.

Roth IRA conversion with distributions calculator. It is possible though not simple. This calculator can help you make informed decisions about performing a Roth conversion in 2022.

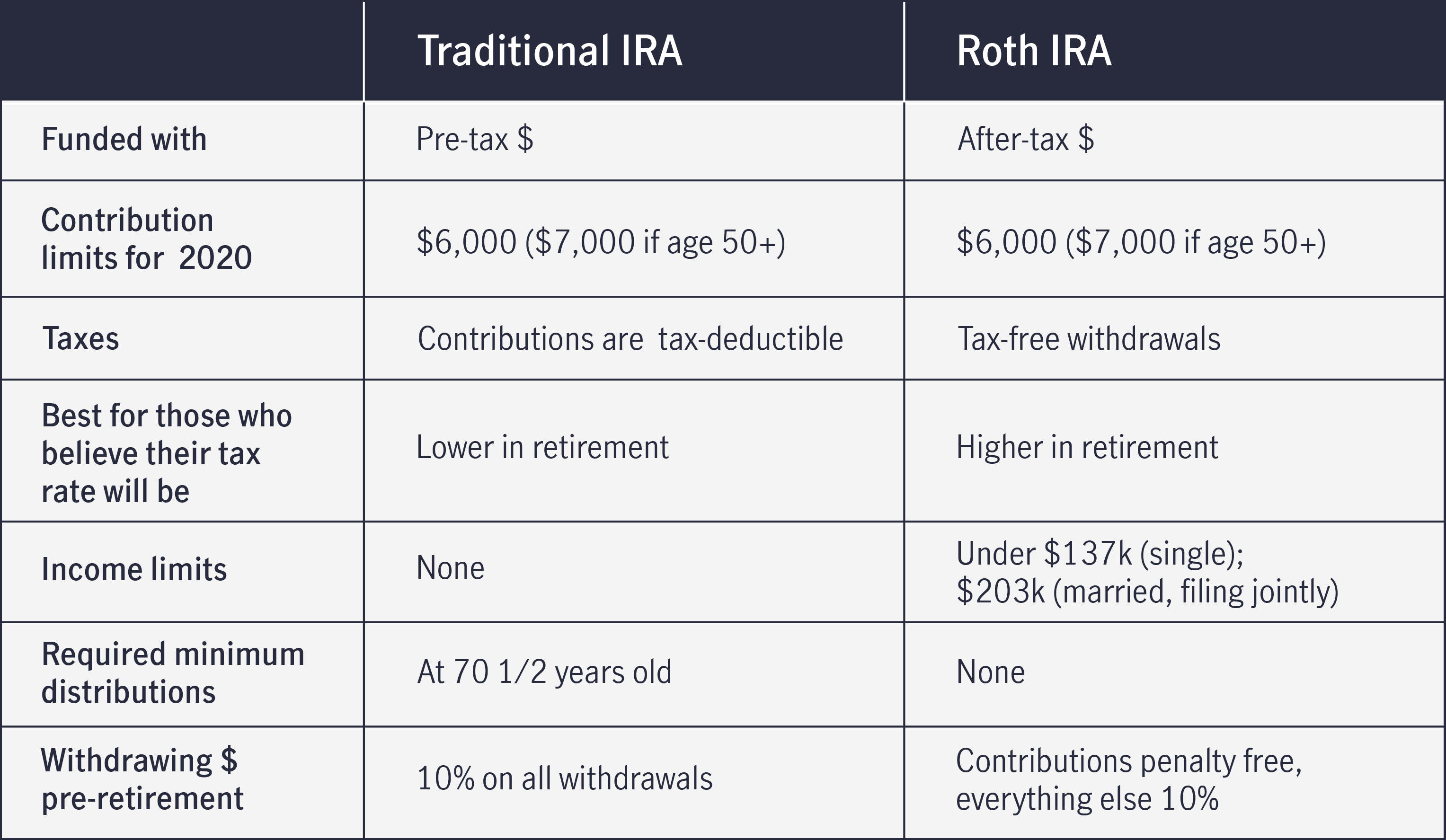

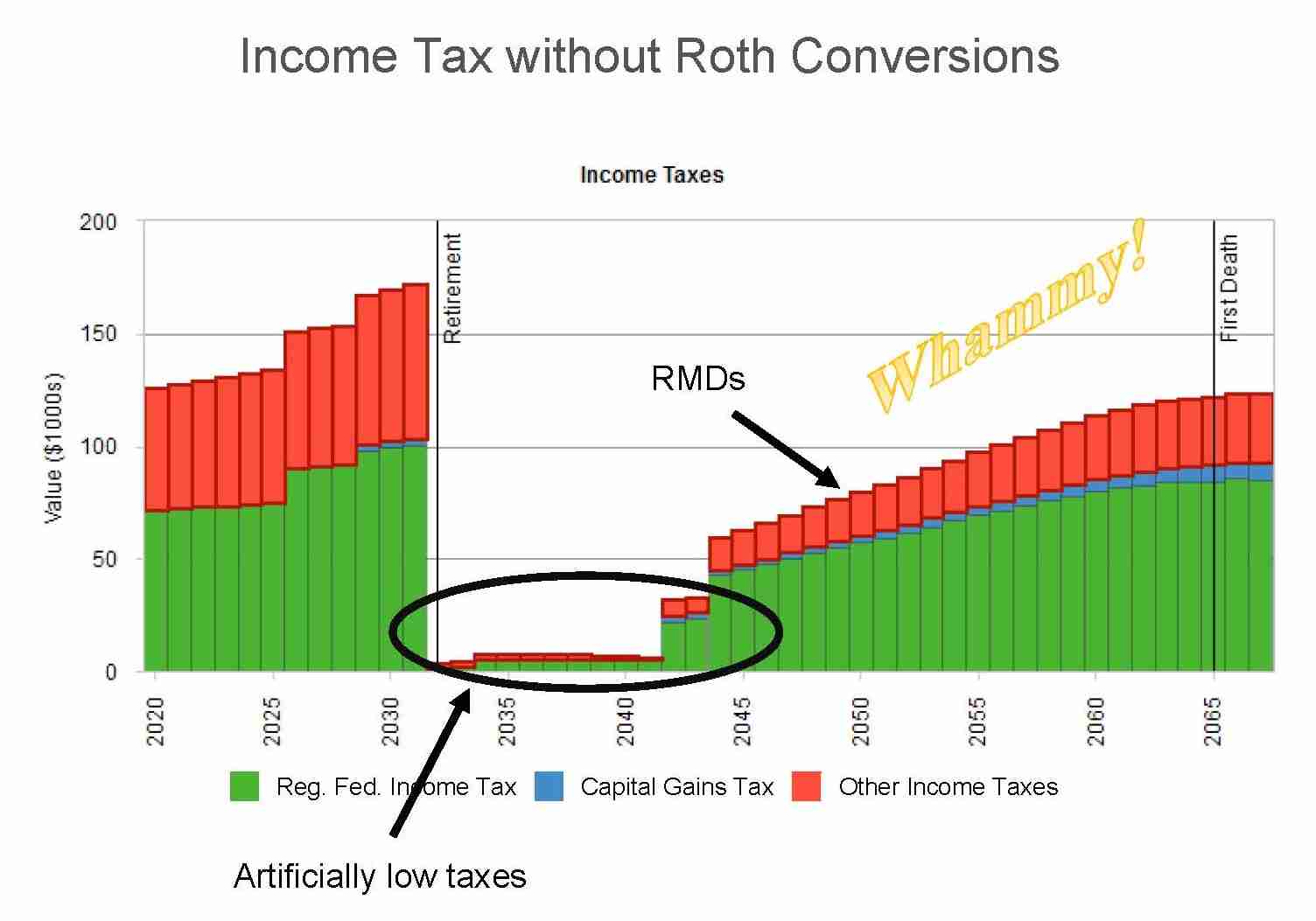

Once converted Roth IRA plans are not subject to required minimum distributions RMD. There are many factors to consider including the amount to convert current tax rate and your age. This calculator compares two alternatives with equal out of pocket costs.

2022 Roth Conversion Calculator. Use this calculator to see how converting your traditional IRA to a Roth IRA could affect your net worth at retirement. Your income for the tax year will.

Ad Discover if a Roth IRA conversion will work for your portfolio in 99 Retirement Tips. The ordinary income generated. There is one method that can benefit you though.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Say youre in the 22 tax bracket and convert 20000. Read Tip 91 to learn more about Fisher Investments advice regarding IRA conversions.

Roth IRA Conversion Calculator In 1997 the Roth IRA was introduced. Ad Find Out Whether Converting Is Beneficial For You. Ad Discover if a Roth IRA conversion will work for your portfolio in 99 Retirement Tips.

Your IRA could decrease 2138 with a Roth. Roth IRA Conversion Calculator. Consider The Different Types Of IRAs.

Read Tip 91 to learn more about Fisher Investments advice regarding IRA conversions. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. It increases your income and you pay your ordinary tax rate on the conversion.

Estimated Federal Income Tax Owed for Planned Roth Conversion. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. If you already have a Traditional IRA you may be considering whether to convert it to a Roth IRA. The federal tax on a Roth IRA conversion will be collected by the IRS with the rest of your income taxes due on the return you file for the year of the conversion.

Schwab Is Here To Answer Your Questions And Help You Through The Process. IRA and Roth IRA Basics. Converting to a Roth IRA may ultimately help you save money on income taxes.

Use the tool to compare estimated taxes when you do. Converted plan balance is allowed to grow tax-free and all withdrawals are tax-free as well. Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will generally pay ordinary income tax on the taxable amount that is converted.

Traditional Vs Roth Ira Calculator

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

Roth Ira Conversions And Taxes Brownlee Wealth Management

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

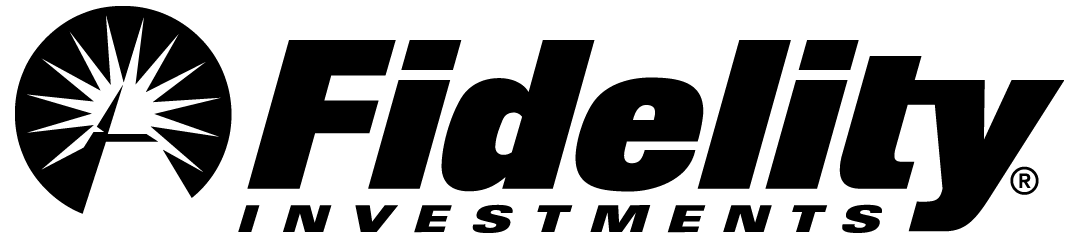

Comparing Traditional Iras Vs Roth Iras John Hancock

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

Systematic Partial Roth Conversions Recharacterizations

Roth Ira Conversions And Taxes Brownlee Wealth Management

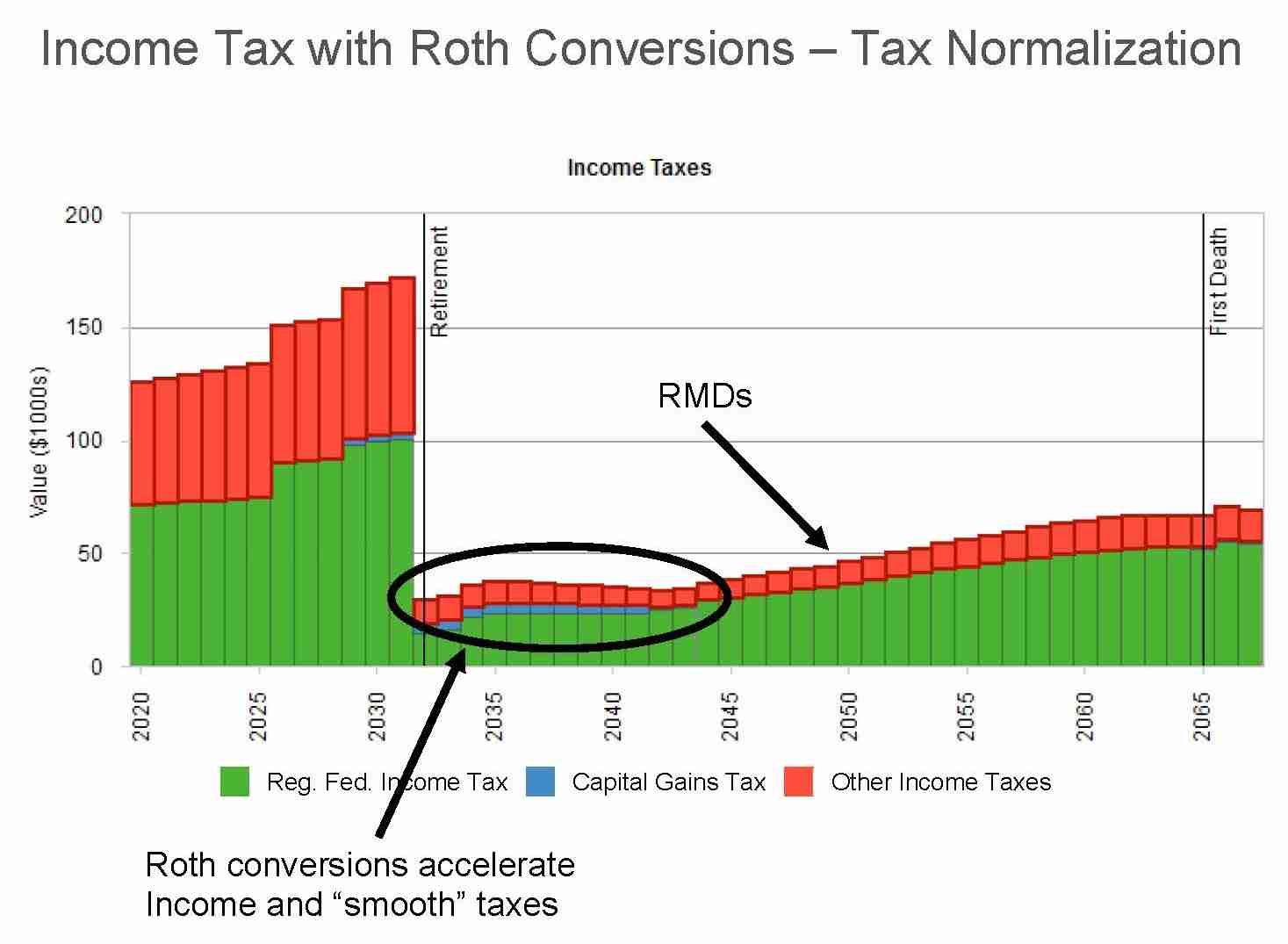

Form 1040 Income Tax Return Irs Tax Forms Income Tax

Systematic Partial Roth Conversions Recharacterizations

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Converting An Ira To A Roth Ira After Age 60 Carmichael Hill

There S A Big Difference Between A Roth Ira And A Traditional Ira Find Out Which Is Best For Retirement Savings Traditional Ira Roth Ira Ira

Retirement Withdrawal Calculator How Long Will Your Savings Last In Retirement Updated For 2020 Investing For Retirement Personal Finance Lessons Spending Money Wisely

Traditional Ira To Roth Ira Conversion For Deployed Military

Converting An Ira To A Roth Ira After Age 60 Carmichael Hill